Luxury Car Tax Australia 2019

Show you how much luxury car tax is payable on a vehicle as added to a car s price by a dealership to determine the sale price.

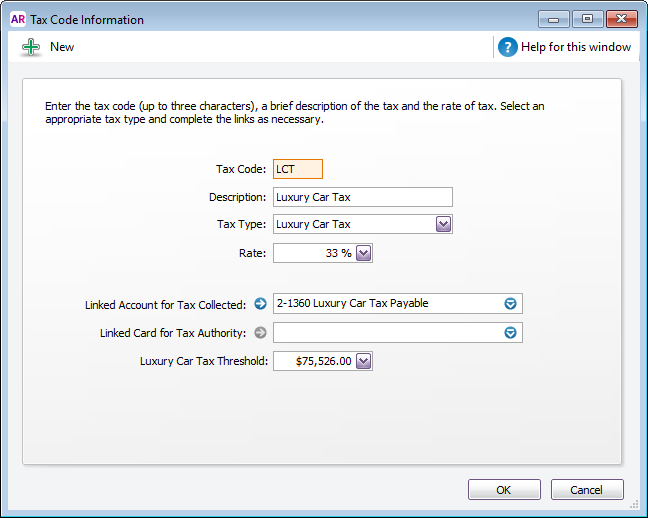

Luxury car tax australia 2019. Automotive industry bodies and political figures have banded together for a renewed push to end the luxury car tax lct following the demise of the holden brand in australia. The luxury car tax is 33 on the dollar amount of the car s value that s over the lct thresholds which according to the australian taxation office ato are as follows. It was an unfair impost on australians. The following table lists the lct thresholds for the relevant financial year the financial year the car was imported acquired or sold.

Critics argue the 33 per cent levy was introduced to protect a local manufacturing industry that no longer exists. Calculate how much tax you ll have to pay and find the answer to your luxury car tax questions. Lct is paid by businesses that sell or import luxury cars dealers and also by individuals who import luxury cars. Luxury car tax lct is a tax charged when you buy a vehicle that meets a set of luxury car criteria.

Toyota australia has long been a proponent of scrapping the luxury car tax the spokesman said. Luxury car tax thresholds. That federal government luxury car tax is levied at a. For lct rates before 3 october 2008 refer to luxury car tax rate previous years.

How do i avoid the luxury car tax in australia. Cars with a luxury car tax lct value over the lct threshold attract an lct rate of 33. Lct is imposed at the rate of 33 on the amount above the luxury car threshold. Financial year fuel efficient vehicles.

The ultimate guide to car brands in australia explore 47 brands. Luxury car tax lct is a tax on cars with a gst inclusive value above the lct threshold. Find out everything you need to know about the luxury car tax and how it could affect you. This calculator can perform two different calculations.

Luxury car tax rate and thresholds luxury car tax rate.